Under the Adult Use of Marijuana Act, the cannabis excise tax in California is currently set at 15% of gross receipts from licensed retail cannabis sales. In addition to this state-level tax, many local governments impose their own additional taxes on cannabis, with some jurisdictions, including Los Angeles, charging as high as 10%.

However, the current system of taxation has led to what some consider to be double or triple taxation on cannabis, creating an unfair burden on the industry. Local governments are required to include state and local excise taxes in the definition of “gross receipts,” which subsequently affects the additional sales taxes imposed on cannabis.

Recognizing this issue, Senate Bill 512 (SB 512) aims to put an end to this multiple taxation on cannabis, providing much-needed relief to the industry. The bill seeks to clarify the tax structure and ensure that cannabis businesses are not unfairly burdened by excessive taxes.

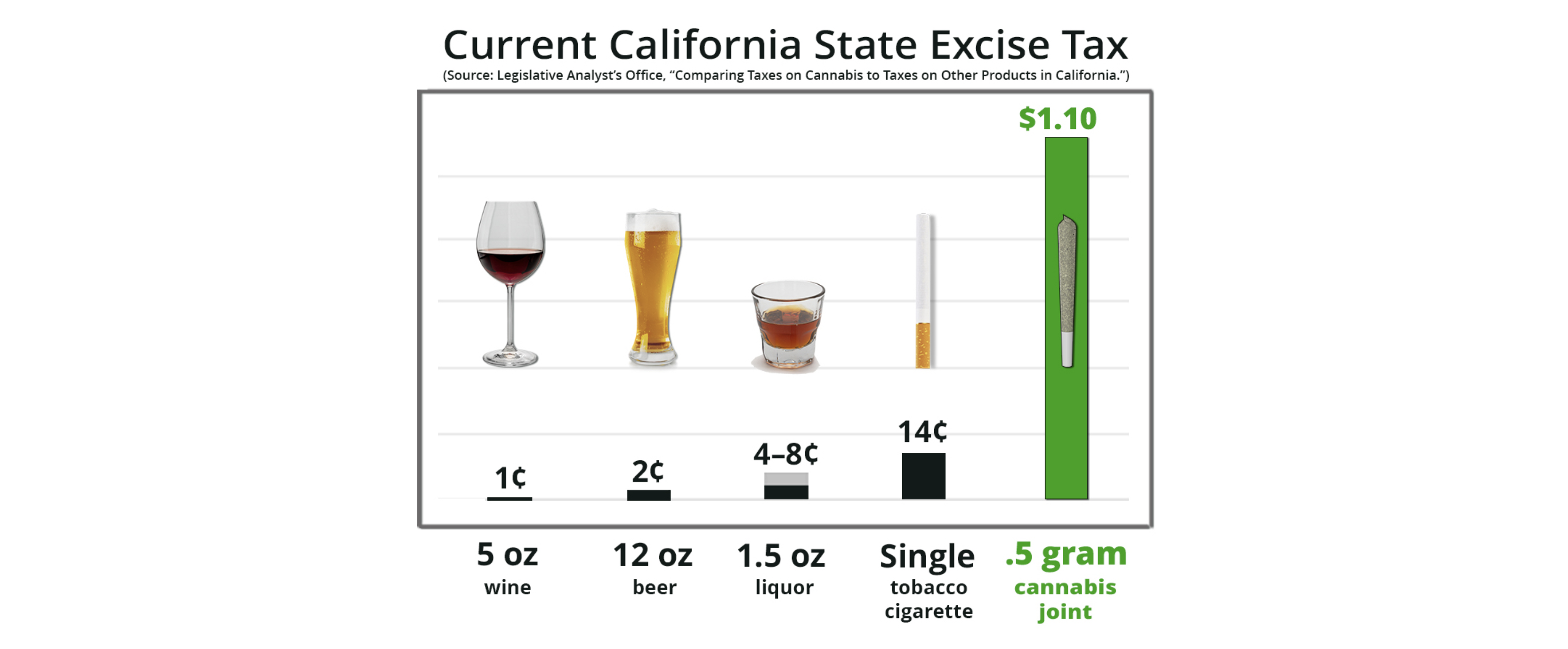

The California chapter of the National Organization for the Reform of Marijuana Laws (CA NORML) is a proponent of SB 512 and encourages individuals to reach out to their lawmakers in support of this proposed legislation. The organization emphasizes that the current taxation of cannabis in California is disproportionate when compared to similar goods. When the sales and use tax of 7.25% to 10.5% is added on top of the 15% excise tax, it results in an increase of 8 to 11 cents in the cost of a joint—more than the total state excise taxes for an alcoholic beverage. Moreover, when local cannabis taxes are factored in, the difference can be as high as 18 cents.

Despite lower sales figures, cannabis sales already contribute more to California’s revenue than alcohol taxes. However, the excessive taxation of cannabis hampers legal access for consumers and inadvertently fuels the illicit cannabis market. Advocates argue that consumers should have access to safe, tested, and fairly taxed cannabis products.

It’s important to understand the background behind the issue. The problem of double taxation arose when the excise tax payment responsibility was shifted from distributors to retailers through the 2022 budget bill AB 195. This change resulted in the definition of gross receipts for assessing sales and use taxes including the 15% excise tax. Furthermore, the California Department of Tax and Fee Administration (CDTFA) instructed retailers to include delivery fees and local taxes in the definition of gross receipts, leading to triple taxation.

Complicating matters further, many local jurisdictions have their own cannabis tax laws that are in direct conflict with the CDTFA’s guidance. For example, the City of Los Angeles has a conflicting definition of their gross receipts tax, leaving retailers in LA and elsewhere vulnerable to fines or loss of licensure.

To illustrate the impact of excessive taxation, a recent $73.35 purchase at a California cannabis shop resulted in the customer paying $97.20 at the register. SB 512 would have saved the customer $2.03 by eliminating the re-taxation of the excise taxes, which represents a small step toward achieving cannabis tax fairness.

If enacted, SB 512 would address the issue of double and triple taxation on cannabis, which is believed to contribute to the resurgence of the illicit market in California. By rectifying the tax structure, the legislation aims to protect the legal cannabis industry and maintain a solid tax base for the state.

If enacted, SB 512 would address the issue of double and triple taxation on cannabis, which is believed to contribute to the resurgence of the illicit market in California. By rectifying the tax structure, the legislation aims to protect the legal cannabis industry and maintain a solid tax base for the state.

In summary, SB 512 is a proposed bill that seeks to address the complex issue of cannabis taxation in California. By eliminating multiple taxation and establishing a fair tax structure, the legislation aims to support the legal cannabis industry, promote consumer access to safe products, and discourage the growth of the illicit market. CA NORML encourages citizens to engage with their lawmakers and express their support for SB 512.

Source: canorml.org

EXPLORE MORE NEWS

Newsletter