Cannabis brands are currently at a crossroads, faced with a critical decision: whether to steer their product towards becoming a luxury consumable or an affordable agricultural commodity. While the trajectory of the cannabis market seems destined to evolve into a luxury goods industry, akin to wine and spirits, the foundations of such luxury brands in other markets were built over years of engagement between consumers, connoisseurs, and producers. To successfully market cannabis products as luxury items, a concerted effort towards well-defined, consumer-accessible branding is required.

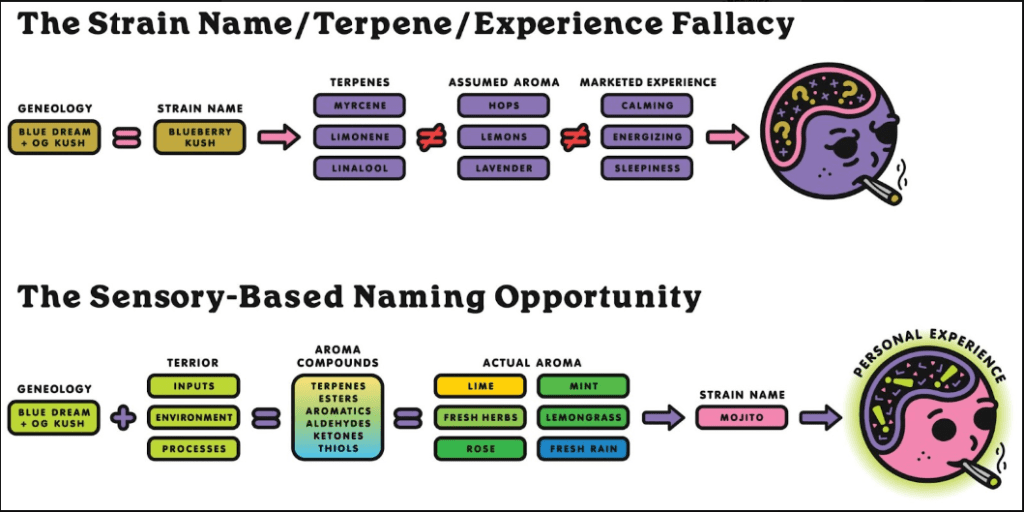

The first and crucial step in transforming a cannabis brand into a luxury offering is overcoming the fixation on cultivar identity. Presently, unregulated cultivar naming impedes creativity and craftsmanship, making it challenging for brands and salespersons to clearly communicate the unique characteristics of their strains.

Illustration of both the conventional branding approach (top) and the sensory-based branding opportunity (bottom)

The good news is that other industries, such as alcohol, coffee, and consumer packaged foods (CPGs), have already done the heavy lifting in this area. They have paved the way with robust sensory science and analytical approaches to product characterization. For the cannabis industry, this means there is an opportunity to adapt these well-established techniques and apply them to cannabis with a similar intention.

Research has shown that aroma is one of the most significant predictors of a positive consumption experience. As adult-use consumers become more familiar with the current array of product offerings and the increasing legal availability of cannabis, they will seek products that consistently provide the best experience. Thus, the most successful cannabis brands will be those that can effectively communicate that experience and consistently deliver it to consumers. Describing aroma using strain names, top terpenes, or THC content, the current status quo, falls short of harmonizing a brand’s promise with the actual consumer experience.

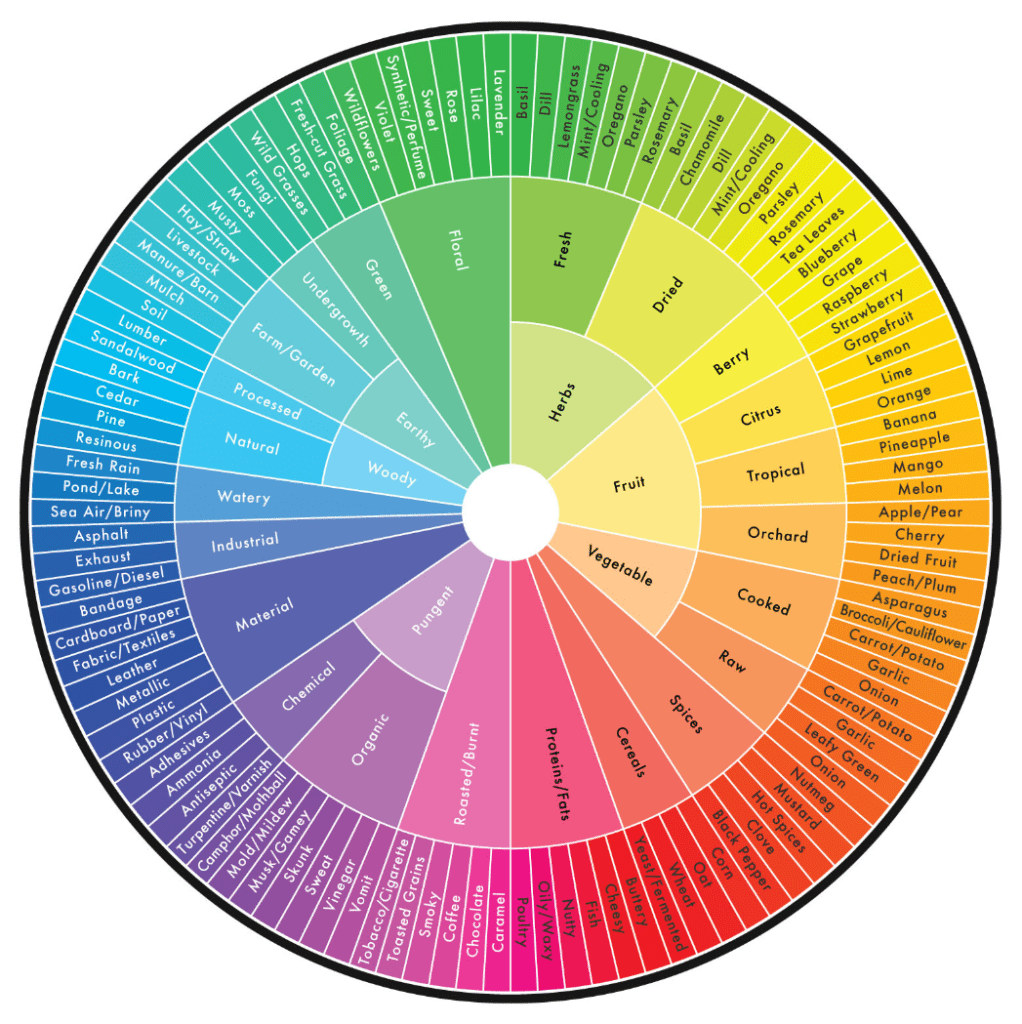

In light of these challenges, the cannabis industry has already begun to take strides towards sensory-based branding. Dr. Ed Szczygiel, a prominent expert in the field, led a groundbreaking study that resulted in a novel cannabis aroma wheel. This wheel was derived from aroma descriptors and evaluated by a panel of trained sensory experts. Through qualitative focus panels, literature reviews, and formal blinded sensory tests, the researchers developed a comprehensive lexicon that serves as a valuable tool for trained evaluators to characterize cannabis aroma accurately. The Cannabis Aroma Lexicon, as it’s known, is freely available and represents just the beginning of a collective development of a data-driven cannabis lexicon.

Much like the World Coffee Research Lexicon, the Cannabis Aroma Lexicon serves a specific purpose: collecting an objective description of the product’s aroma. Over time, this living document will continue to grow and expand along with the cannabis industry. In the future, lexicons may extend to describe more than just aroma, encompassing tactile and appearance sensory attributes of cannabis, presenting more opportunities for deep craftsmanship in the industry.

The role of dispensaries becomes increasingly critical in the adoption of standardized quality metrics. For cannabis to be considered a craft product, the presence of a third-party expert guiding consumers during the purchasing process is essential. Similar to asking a knowledgeable waiter for a wine pairing, consumers rely on dispensaries to understand the properties of the cannabis products they are buying. However, the lack of knowledge about the physiological and sensorial effects of cannabis has led to inconsistent experiences, leaving consumers yearning for greater trust in the products they purchase.

Embracing sensory science in the cannabis industry presents a unique opportunity for brands to build consumer trust and differentiate their products in a market flooded with strain names and high-potency flower. By establishing cultivars as measurably aromatic with specific characters, brands can leverage the aroma profile to add significant value to their products. For instance, aligning the cultivar name with the perceived aroma can avoid mismatched expectations, enhancing consumer trust.

Expert-derived aroma wheel tool for cannabis aroma characterization.

Moreover, consolidating and optimizing the product catalog can prevent sales cannibalization, as brands can grow specific products to meet the needs of consumer groups effectively. This approach also eliminates guesswork from the breeding process, as products can be measured against sensory goals to ensure consistency over time. Additionally, demonstrating transparency by utilizing controlled, blinded studies to profile aromas will attract ethical consumers and add value to the products.

Furthermore, brands that become leaders in connoisseurship can position themselves ahead of the competition. By utilizing aroma profiling, products can be more easily sold by budtenders and salespeople, elevating the dispensary experience and fostering consumer loyalty.

This emphasis on sensory-based branding opens doors to new application types. Brands can explore offering seasonal, occasion-centered, or geographically unique cultivars, catering to the diverse preferences of consumers. In doing so, aroma characterization will not only differentiate products but also contribute to the overall maturity of the cannabis industry.

By adopting this approach, cannabis brands will not only improve the consumer experience by providing a means to compare products but also promote the adoption of good manufacturing practices that improve the quality and safety of cannabis products. Without consumer-accessible quality metrics, brands may have little incentive to produce products of elevated quality and might prioritize quantity to meet minimum regulatory requirements.

In conclusion, cannabis businesses stand at the cusp of an inevitable industry-wide shift towards connoisseurship and the application of robust sensory science. While breaking free from current “bad habits” may be challenging for many brands, the potential for cannabis as a luxury good is significant. Consumers are eager for a better cannabis experience, from purchase to consumption, and sensory profiling presents an unparalleled opportunity to meet their expectations. By leveraging sensory science and crafting well-defined, consumer-accessible branding, cannabis brands can thrive in a market full of luxury offerings. The time to prepare is now, and those who take these steps will be well-positioned for success in the ever-evolving cannabis landscape.

Source: Cannabis Industry Journal

EXPLORE MORE NEWS

Newsletter