Republican Resistance Blocks Medical Cannabis Legalization Push in North Carolina

Republican resistance has effectively halted the push for medical cannabis legalization in North Carolina. State House Speaker Tim Moore believes that the opposition from Republican lawmakers has doomed the prospects of passing the Compassionate Care Act in 2023. Despite the state Senate’s approval of the bill, which aimed to provide access to smokable flower for patients with 15 qualifying medical conditions in a tightly regulated market, the House took no further action beyond a committee hearing.

The news story reflects a recurring pattern in North Carolina’s legislative history regarding the push for medical cannabis legalization. North Carolina, like many conservative-leaning states, has traditionally faced challenges in embracing cannabis policy changes due to concerns over public health, law enforcement, and moral considerations.

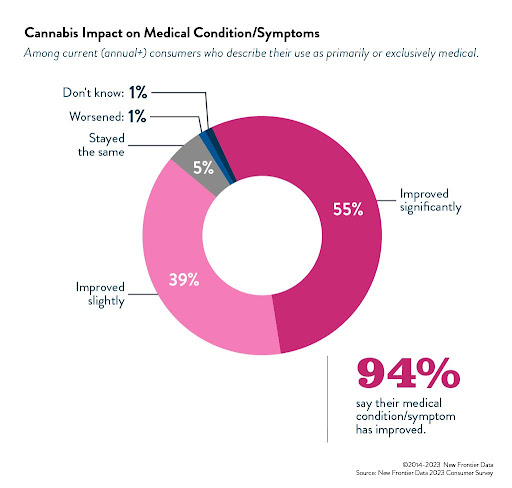

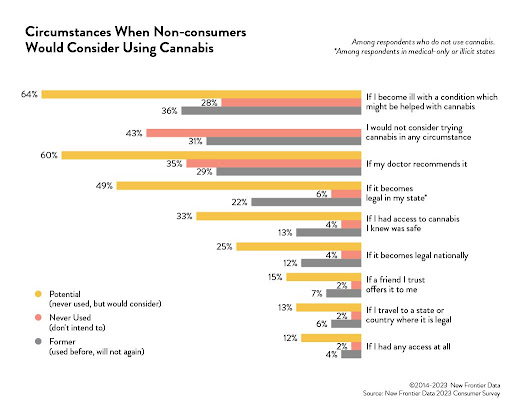

In recent years, however, there has been an increasing public acceptance of medical cannabis as a viable treatment option for various health conditions. This has led to a shift in public opinion, with a majority of Americans now supporting medical cannabis legalization. Despite this trend, translating public support into legislative action can be difficult, especially in states with conservative political climates.

North Carolina’s struggle with medical cannabis legalization is not unique. In 2021, a similar bill passed the state Senate but failed to advance in the House, illustrating the challenges faced in achieving bipartisan consensus on the issue. This recurring pattern suggests a significant divide within the state’s legislative bodies when it comes to cannabis policy.

State House Speaker Tim Moore’s statement about the bill’s fate reflects the influence of party dynamics within the legislative process. Republican lawmakers, who hold a majority in the House, voiced their opposition to the bill. According to House Republican Caucus rules, a bill must have majority support from members before it can be heard on the floor, making it difficult for the bill to advance. Even if the bill had received support from some Democratic members, Republican opposition would have been the deciding factor.

Despite this setback, there is hope for renewed efforts in the future. Speaker Moore remains optimistic that the issue will be addressed again when the next legislative session begins in May. Proponents of medical cannabis legalization are likely to regroup and strategize during this time, aiming to build broader support and address concerns raised by opponents.

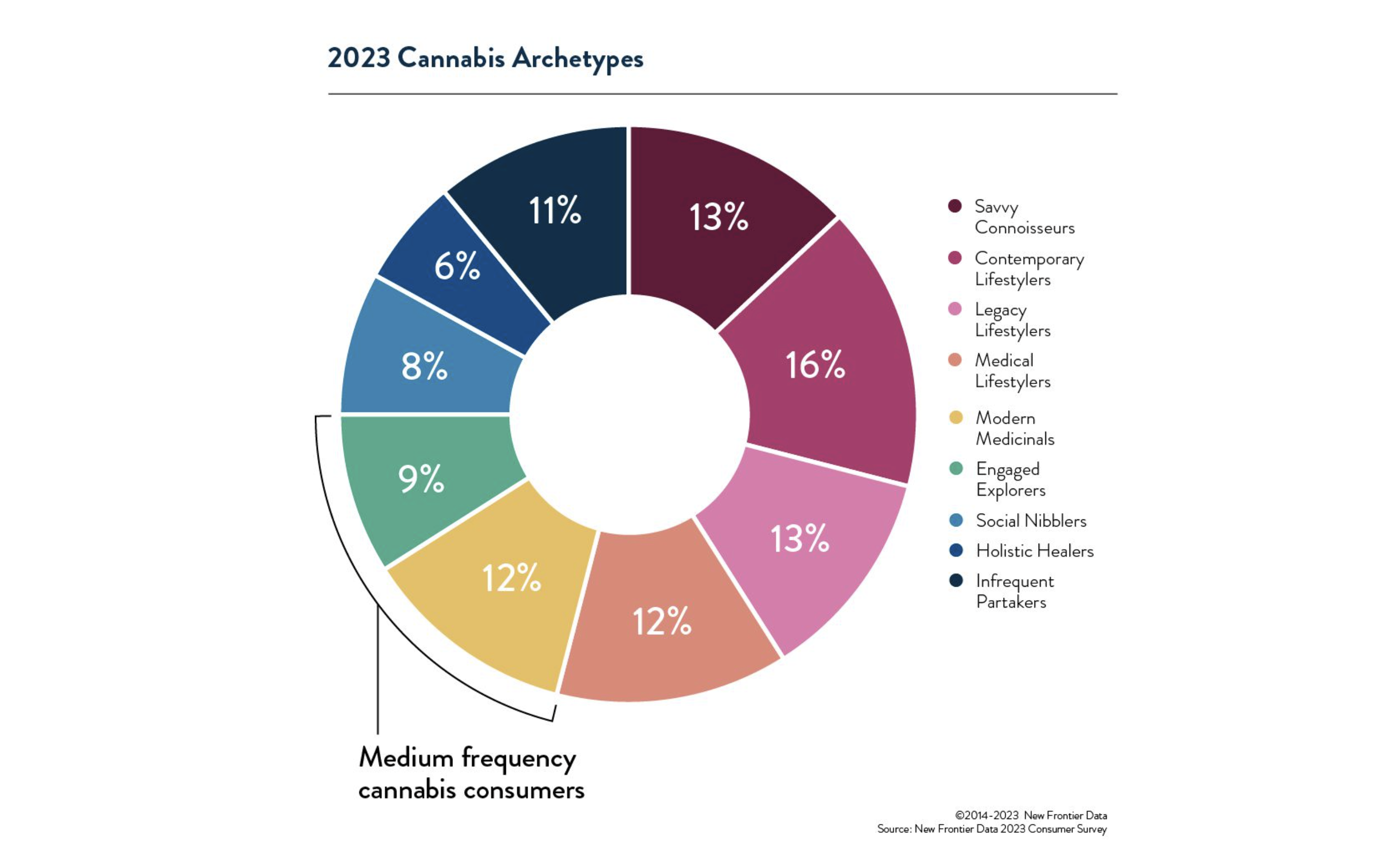

The future of medical cannabis in North Carolina hangs in the balance, as stakeholders continue to engage in discussions, emphasizing the potential benefits for patients and the economic impact of a regulated cannabis market. Proponents will likely highlight the growing body of evidence supporting the therapeutic uses of cannabis and its potential to provide relief for patients with qualifying medical conditions. They may also address concerns raised by opponents, such as implementing strict regulations to ensure safety and prevent abuse.

As the legislative landscape evolves and public opinion continues to shift, the push for medical cannabis legalization in North Carolina may face renewed momentum. It remains to be seen how the issue will unfold in subsequent legislative sessions, but the ongoing dialogue and advocacy efforts indicate a persistent drive to bring medical cannabis access to patients in need.

Source: Mjbizdaily

EXPLORE MORE NEWS

Newsletter