The Changing Landscape of Cannabis Product and Sourcing Choices

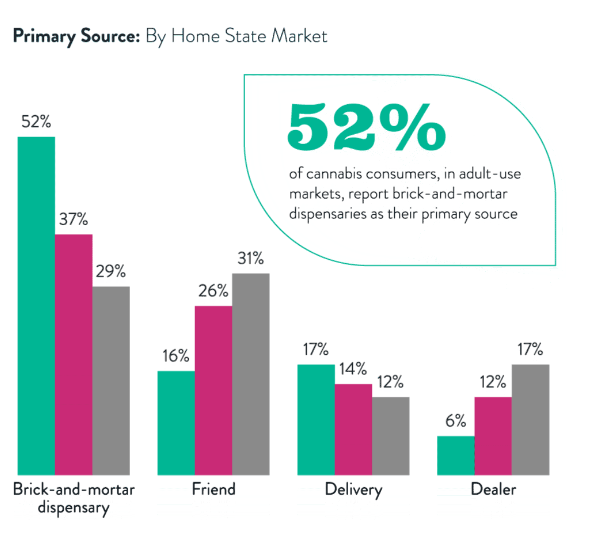

According to the latest data from New Frontier, consumer behavior regarding the purchase of cannabis products is experiencing a notable shift. The data reveals that more consumers are opting to order their cannabis products from brick and mortar dispensaries, indicating a growing preference for in-person shopping experiences. In 2022, 34% of consumers chose physical dispensaries, and this figure has risen to 43% in 2023. Additionally, there has been a slight reduction in cannabis delivery, with 18% of consumers utilizing this option in 2022, which has decreased to 15% in 2023. This trend can be attributed to a post-COVID era where individuals feel more comfortable leaving their homes and seeking out physical retail experiences. In this article, we will explore the normalization of cannabis product and sourcing choices, and how these changes are shaping the industry.

The cannabis industry has witnessed significant transformations ovcer the past few years, propelled by shifting consumer preferences and evolving legal frameworks. As cannabis becomes more mainstream and socially accepted, consumers are becoming increasingly discerning about their product choices and the channels through which they acquire them. The data from New Frontier reflects a growing inclination towards brick and mortar dispensaries, signaling an important transition in the cannabis purchasing landscape. (Brick and mortar refers to a physical business establishment, typically characterized by a storefront. It is a term commonly used in the context of retail and encompasses physical stores, shops, or outlets where customers can directly visit and engage in face-to-face transactions).

Despite the rise of online shopping and e-commerce, brick and mortar businesses continue to hold significance in the commercial landscape. They provide opportunities for personal interactions, immediate gratification, and the ability to build trust between businesses and customers through direct engagement. While the retail landscape continues to evolve, brick and mortar establishments remain an integral component of consumer culture and contribute to the overall vibrancy of local economies.

Now let’s break down the data from the infographic:

Adult Use %:

Adult Use refers to the percentage of consumers who use cannabis for recreational purposes, also known as adult use. It focuses on the preferences of individuals who consume cannabis without a medical prescription.

Brick and Mortar: This percentage represents the portion of adult cannabis users who choose to purchase their products from physical dispensaries or retail stores. It indicates the growing popularity of in-person shopping experiences and suggests a preference for a comprehensive and immersive cannabis purchasing experience.

Delivery: This percentage represents the portion of adult cannabis users who opt for delivery services to receive their products. It indicates the convenience and accessibility of having cannabis products delivered directly to their doorstep. However, as mentioned earlier, the data shows a slight reduction in this category, possibly due to a shift towards in-person shopping experiences.

Friend: This percentage represents the portion of adult cannabis users who acquire their products through a friend. This often involves informal transactions where a friend, who may have purchased cannabis legally or illegally, supplies the product to the consumer. This method is more common in social circles where individuals share cannabis among themselves.

Dealer: This percentage represents the portion of adult cannabis users who rely on a traditional dealer to obtain their products. These dealers operate outside of the legal market and provide cannabis that may be of uncertain quality and legality. The data likely reflects a segment of consumers who either cannot access legal channels or prefer to obtain cannabis through illicit means.

Medical Use %:

Medical Use focuses on the percentage of consumers who use cannabis for medical purposes. These individuals typically have a medical prescription or recommendation from a healthcare professional, and their cannabis use is aimed at alleviating specific symptoms or managing medical conditions.

Brick and Mortar: This percentage represents the portion of medical cannabis users who choose to purchase their products from physical dispensaries. It highlights the importance of knowledgeable staff and a wide selection of products for individuals seeking cannabis as a medical treatment. Physical dispensaries provide an environment where patients can interact with budtenders, receive guidance, and find products that suit their medical needs.

Delivery: This percentage represents the portion of medical cannabis users who rely on delivery services to obtain their products. For patients who may have mobility issues or prefer the convenience of home delivery, this option ensures access to their medication without having to leave their residence.

Friend: This percentage represents the portion of medical cannabis users who acquire their products through a friend. Similar to the adult use category, some medical cannabis patients may rely on friends who have legal access to cannabis or who cultivate it for personal medical use. This method often involves informal transactions within trusted networks.

Dealer: This percentage represents the portion of medical cannabis users who obtain their products from illegal or unregulated sources. This may be due to various factors such as limited access to legal medical cannabis, challenges in obtaining medical prescriptions, or personal preferences for acquiring cannabis outside of the regulated market.

Illicit States %:

Illicit States refers to the percentage of consumers who reside in states where cannabis is illegal for both recreational and medical use. These consumers do not have access to legal channels for purchasing cannabis products and may resort to alternative means.

Brick and Mortar: This percentage represents the portion of consumers in illicit states who still manage to access cannabis through physical dispensaries. It indicates the presence of unregulated or underground cannabis markets within these states, where individuals can find cannabis products despite legal restrictions.

Delivery: This percentage represents the portion of consumers in illicit states who rely on delivery services to obtain cannabis products. Similar to the brick and mortar category, this indicates the existence of unregulated delivery services operating within illegal cannabis markets.

Friend: This percentage represents the portion of consumers in illicit states who acquire cannabis products through friends. Due to the lack of legal access, individuals may rely on personal connections to obtain cannabis from friends who have access to legal or illicit sources. This method allows consumers to bypass the restrictions imposed by illegal cannabis markets.

Dealer: This percentage represents the portion of consumers in illicit states who rely on traditional dealers to acquire cannabis. In states where cannabis is illegal, underground dealers or black market networks may thrive, supplying cannabis products outside of regulatory frameworks. Consumers in these states may turn to dealers as their primary source for obtaining cannabis.

One possible explanation for the surge in brick and mortar dispensary visits is the desire for a more immersive and personalized shopping experience. While online ordering and delivery services provide convenience, physical stores offer consumers the opportunity to interact with knowledgeable staff, explore a wider range of products, and benefit from in-person recommendations. This shift in consumer behavior reflects the growing demand for a comprehensive shopping experience that combines education, product variety, and face-to-face engagement.

Moreover, the decline in cannabis delivery services can be attributed to the changing dynamics of post-pandemic life. As vaccination rates increase and individuals regain a sense of normalcy, they are more inclined to venture out of their homes for various activities, including shopping for cannabis. The comfort and safety concerns that once necessitated delivery services are gradually subsiding, allowing consumers to embrace the tactile experience of physically browsing dispensary shelves and making their selections in person.

The normalization of cannabis product and sourcing choices also points to the growing sophistication of consumers. As the industry expands and product options diversify, consumers are developing a refined taste for specific strains, product formats, and brands. In physical dispensaries, customers can engage directly with budtenders, who provide valuable insights and guidance on product characteristics, effects, and potential therapeutic benefits. This personalized approach empowers consumers to make more informed decisions about their cannabis purchases, ultimately enhancing their overall satisfaction.

Furthermore, the increased preference for brick and mortar dispensaries may have positive implications for the wider cannabis industry. Physical stores not only drive local economic growth but also foster a sense of community among cannabis enthusiasts. Dispensaries often host educational events, product launches, and social gatherings that facilitate knowledge sharing and social interaction within the cannabis community. By embracing physical dispensaries, consumers are actively contributing to the establishment and sustainability of a vibrant cannabis culture.

Benefits of Using Licensed Retailers (Brick and Mortar / Delivery):

Quality and Safety Assurance: Licensed retailers in the legal cannabis industry are subject to regulations and quality control measures. They source their products from licensed producers who adhere to stringent standards for cultivation, processing, and testing. By purchasing from licensed retailers, consumers can have confidence in the quality and safety of the cannabis products they are obtaining. This assurance is lacking when acquiring cannabis from friends or dealers, where the source and quality may be uncertain.

Product Variety and Selection: Licensed retailers offer a wide range of cannabis products, including different strains, formats (such as flowers, edibles, topicals, and concentrates), and potency levels. They often carry products from multiple brands, providing consumers with a diverse selection to choose from. This variety allows consumers to explore and find products that best suit their preferences and needs. Friends or dealers may have limited product options and may not offer the same level of variety.

Knowledgeable Staff and Education: Licensed retailers employ trained staff who possess knowledge about different cannabis strains, product effects, dosages, and consumption methods. They can provide personalized guidance and recommendations based on consumers’ preferences, desired experiences, and medical needs. Licensed retailers prioritize consumer education, helping individuals make informed decisions about their cannabis purchases. Friends or dealers may not have the same level of expertise or the ability to offer comprehensive information and guidance.

Legality and Compliance: Using licensed retailers ensures compliance with local and state laws regarding cannabis purchase and possession. Consumers can avoid legal complications and potential risks associated with obtaining cannabis from unregulated sources. Licensed retailers operate within the framework of the law, promoting a responsible and legal cannabis market.

Driving Adoption of Product Sales through Licensed Retailers (Brick and Mortar / Delivery):

Awareness Campaigns: The licensed cannabis industry can invest in educational campaigns that highlight the benefits of purchasing from licensed retailers. These campaigns can emphasize the quality assurance, product variety, and safety aspects that come with purchasing from regulated sources. By increasing consumer awareness and understanding, the industry can encourage more individuals to choose licensed retailers over friends or dealers.

Enhancing Customer Experience: Licensed retailers should focus on providing exceptional customer experiences. This includes creating welcoming environments, offering personalized recommendations, and providing education about the products they carry. By prioritizing customer satisfaction and building trust, licensed retailers can attract more customers and retain their loyalty.

Collaboration with Healthcare Professionals: Establishing partnerships with healthcare professionals can help promote the use of licensed retailers for medical cannabis needs. By educating healthcare providers about the benefits of regulated cannabis products and referring patients to licensed retailers, the industry can drive more adoption of product sales through legal channels.

Convenience and Accessibility: Licensed retailers, both brick and mortar and delivery services, should strive to offer convenient and accessible options to consumers. This includes online ordering platforms, fast and reliable delivery services, and ensuring that dispensaries are located in areas easily accessible to customers. By prioritizing convenience, the licensed industry can compete with the convenience often associated with obtaining cannabis from friends or dealers.

Regulated Market Expansion: The growth and expansion of the licensed cannabis industry play a crucial role in driving adoption of product sales through licensed retailers. As more states or countries legalize cannabis, it becomes easier for consumers to access regulated markets. By advocating for responsible regulation and expanding legal access, the industry can create an environment where licensed retailers are the preferred and convenient option for consumers.

By emphasizing the benefits of licensed retailers, improving the customer experience, and expanding the regulated market, the licensed cannabis industry can effectively drive more adoption of product sales through licensed retailers, reducing reliance on friends or dealers and promoting a safer and more regulated cannabis market.

The shifting consumer behavior observed in the latest data from New Frontier reflects the normalization of cannabis product and sourcing choices. With a greater emphasis on brick-and-mortar dispensaries and a slight decrease in delivery services, consumers are seeking more immersive and personalized experiences when purchasing cannabis products. This trend signifies a growing sophistication among consumers, a desire for face-to-face engagement, and a sense of confidence in leaving home post-COVID. As the industry continues to evolve, understanding and adapting to these changing consumer preferences will be crucial for businesses to thrive in the competitive cannabis market.

EXPLORE MORE NEWS

Newsletter